What Is EMV?

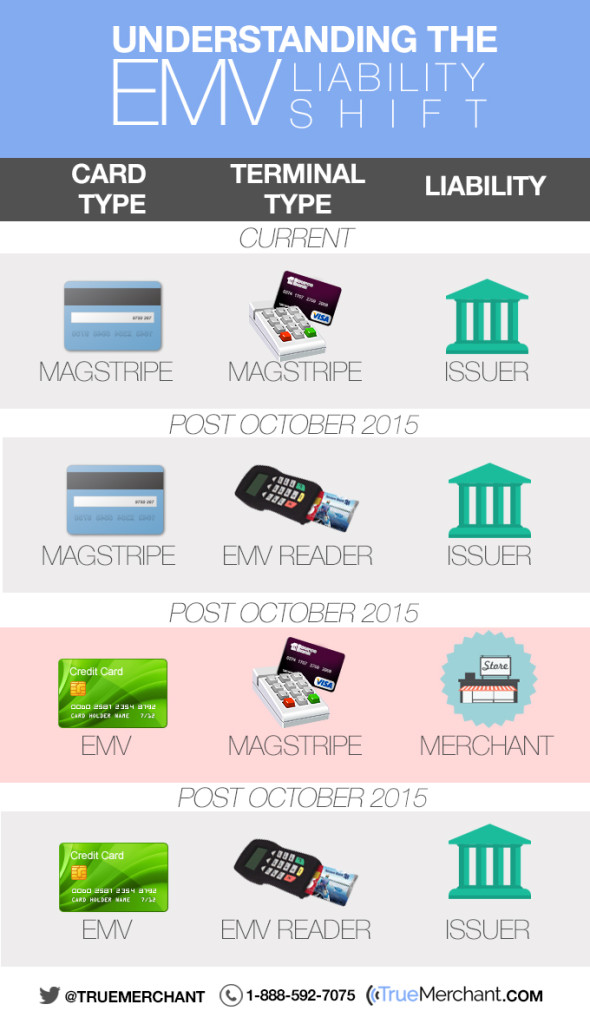

EMV Liability Shift – What scenarios is a retailer liable for fraud?

This document shows how liability may be assessed for:

- a magnetic stripe card used at a magnetic stripe payment terminal

- an EMV chip card is used at a traditional magnetic stripe payment terminal

- an EMV chip card is used at a chip enabled terminal that has been activated by the retailer or merchant

This infographic from Visa explains what liability rests with the retailer or merchant and the card issuer in various payment situations.

Source: http://www.truemerchant.com/

The date for EMV adoption is October 2015 for in-store point of sale for C-stores and other retailers. For gas pumps (AFD's), EMV adoption and liability shift will occur on October 1, 2017.

EMVco

EMVCo exists to facilitate worldwide interoperability and acceptance of secure payment transactions. It accomplishes this by managing and evolving the EMV® Specifications and related testing processes. This work is overseen by EMVCo’s six member organizations—American Express, Discover, JCB, MasterCard, UnionPay, and Visa—and supported by dozens of banks, merchants, processors, vendors, and other industry stakeholders.

How does an EMV Chip Card work?

A useful infographic from Visa that explains how EMV cards are designed and how EMV processing works.

Mastercard EMV Roadmap

MasterCard has developed a roadmap focused on advancing the U.S. electronic payments system while providing each customer flexibility to manage technology implementation that advances their business goals. Information of interest to C-store owners related to gas pumps, point of sale (POS), and other payment products.

Incentives are laying the path for U.S. adoption of the EMV chip card standard, in use in most developed countries. More than 575 million chip-enabled cards are expected to be in circulation by the end of 2014 and fraud costs are scheduled to shift to merchants and acquirers that don’t meet EMV requirements.

3565 Piedmont Road, NE Building 1 Suite 430 Atlanta, GA 30305 877-527-0383

Disclaimer

You are leaving the Patriot Capital website. Patriot Capital is not responsible for and has no control over the subject matter, content, information or graphics when viewing links attached to Patriot Capital’s website.

You are leaving the Patriot Capital website and will be redirected to SNL Financial, our Investor Relations provider. Please be aware that privacy policies and security standards of a third party site may differ from those of Patriot Capital.